Get the free preapproval letter for mortgage example

Show details

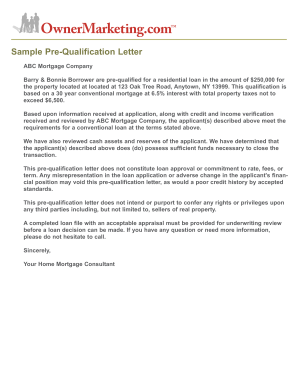

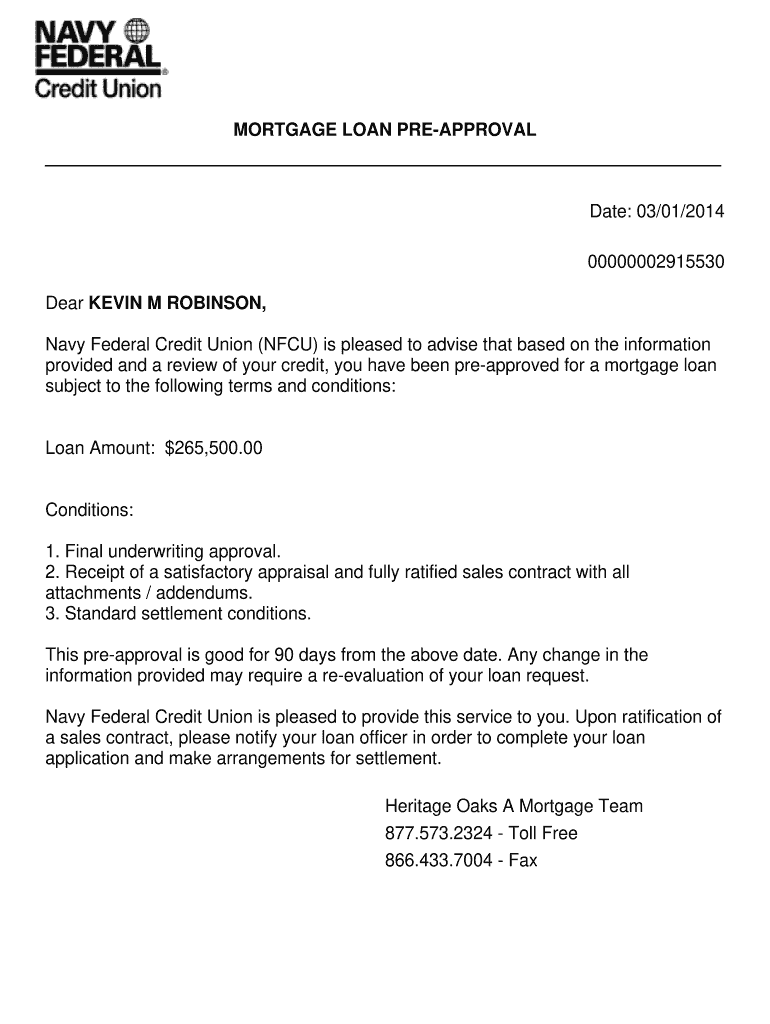

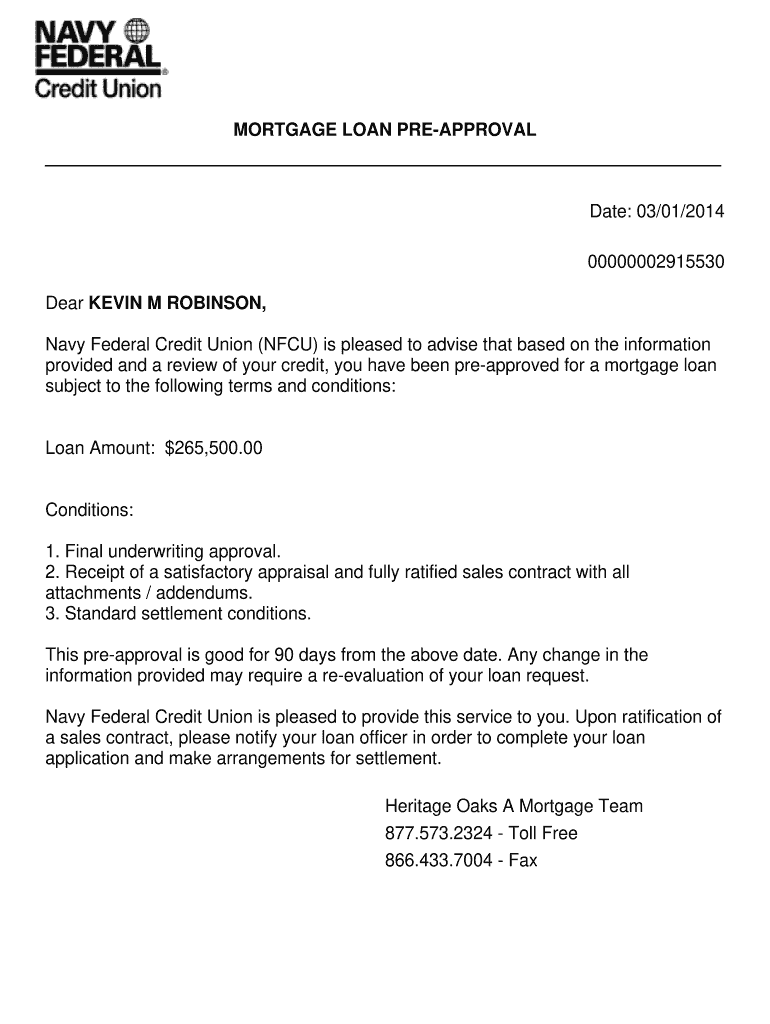

MORTGAGE LOAN PRE-APPROVAL

_____________________________________________________________________

Date: 03/01/2014

00000002915530

Dear KEVIN M ROBINSON,

Navy Federal Credit Union (NFCU) is pleased to advise that based on the information

provided and a review of your credit, you have been pre-approved for a mortgage loan

subject to the following terms and conditions:

Loan Amount: $265,500.00

Conditions:

1. Final underwriting approval.

2. Receipt of a satisfactory appraisal and fully ratified...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign what does a pre approval letter look like form

Edit your auto loan pre approval letter sample form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage pre approval letter form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage approval letter online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit prequalification letter example form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pre qualification letter sample form

How to fill out Navy Federal Credit Union Mortgage Loan Pre-Approval

01

Gather necessary documents including proof of income, employment verification, and credit information.

02

Visit the Navy Federal Credit Union website or a local branch to access the mortgage loan pre-approval application.

03

Complete the application form with accurate personal and financial information.

04

Submit the required documents along with your application.

05

Review the terms and conditions of the pre-approval offer once received.

06

Ask any questions you may have about the process or terms before finalizing your pre-approval.

Who needs Navy Federal Credit Union Mortgage Loan Pre-Approval?

01

First-time homebuyers looking for financing options.

02

Homeowners looking to refinance their current mortgage.

03

Individuals transitioning to a new home and needing financial backing.

04

Borrowers who want to understand how much they can afford before shopping for a home.

Fill

preapproval letter example

: Try Risk Free

People Also Ask about commercial loan pre approval letter sample

What are the five things you need for pre-approval?

Requirements for Pre-Approval Proof of Income. Proof of Assets. Good Credit. Employment Verification. Other Documentation.

How do you read a pre-approval letter?

How to Read Your Pre-approval Letter Check the amount that as been approved. Ignore the interest rate, if included. A bank's pre-approval letter doesn't mean that you can use it for any house you want. Pay attention to the 'approval conditions' or 'specific conditions'. Take note of the expiry date.

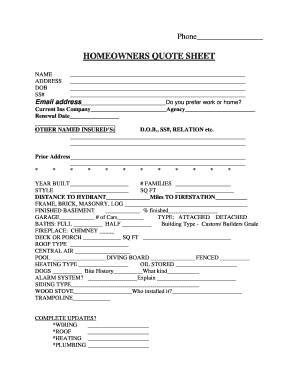

What should a pre-approval letter contain?

Pre-approval letters typically contain the following: Borrower. Lender. Loan amount/purchase price. Interest rate. Term (number of repayment months) Type of property (single-family, condo, etc.)

What happens after you get your pre-approval letter for a mortgage?

The lender will then use these documents to determine exactly how much you can be preapproved to borrow. Once you're preapproved, you'll have 90 days to find a home you love. Then you can lock your rate and complete your application.

How do I write a simple pre-approval letter?

Here are the items the letter will usually contain: Name of lender and contact information. Date issued (pre-approvals are typically valid for 90 days) Borrower(s) name. Purchase price. Loan amount (purchase price minus the down payment) Loan term (15-year, 30-year, ARM, etc.) Monthly payment.

What should be included in a pre-approval letter?

Pre-approval letters typically contain the following: Borrower. Lender. Loan amount/purchase price. Interest rate. Term (number of repayment months) Type of property (single-family, condo, etc.)

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in sample pre approval letter for home loan?

The editing procedure is simple with pdfFiller. Open your mortgage pre approval letter example in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I edit sample of pre approval letter for mortgage on an Android device?

You can make any changes to PDF files, like pre approval letter sample, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

How do I complete mortgage pre approval template on an Android device?

Complete your mortgage pre approval letter pdf and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is Navy Federal Credit Union Mortgage Loan Pre-Approval?

Navy Federal Credit Union Mortgage Loan Pre-Approval is a process that assesses a borrower's financial situation and creditworthiness to determine how much they can borrow for a mortgage. It provides prospective homebuyers with a conditional commitment from the lender based on their financial information.

Who is required to file Navy Federal Credit Union Mortgage Loan Pre-Approval?

Anyone looking to secure a mortgage loan through Navy Federal Credit Union is required to file for Mortgage Loan Pre-Approval. This process is typically done by homebuyers or those interested in refinancing their existing mortgage.

How to fill out Navy Federal Credit Union Mortgage Loan Pre-Approval?

To fill out Navy Federal Credit Union Mortgage Loan Pre-Approval, applicants should complete the online application form available on the Navy Federal website or visit a local branch. They will need to provide personal and financial information, including income, employment details, outstanding debts, and credit history.

What is the purpose of Navy Federal Credit Union Mortgage Loan Pre-Approval?

The purpose of Navy Federal Credit Union Mortgage Loan Pre-Approval is to help borrowers understand how much they can afford when buying a home, streamline the homebuying process, and make their offer more competitive in the real estate market.

What information must be reported on Navy Federal Credit Union Mortgage Loan Pre-Approval?

The information that must be reported on the Navy Federal Credit Union Mortgage Loan Pre-Approval includes personal identification details, income statements, employment history, monthly expenses, outstanding debts, and credit score information.

Fill out your Navy Federal Credit Union Mortgage Loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

House Approval Letter is not the form you're looking for?Search for another form here.

Keywords relevant to mortgage pre approval letter template

Related to sample preapproval letter for mortgage

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.